On January 1 2017 XYZ Company signed an 8-year lease agreement for equipment. Youve already determined that your car rental activity is a business and its conducted for profit.

Capital Lease Vs Operating Lease Difference And Comparison Diffen

Its a nature of operating lease.

. U should treat ur Cars as fixed asset and charge depreciation. The rate of inflation over the preceding 12 months is 5 then at the end of the first year the lease liability is recalculated assuming future annual rentals of 2625000 ie. Keep track of which of your properties are profitable and which are costing you money.

If you apply IAS 19 you would recognize an expense and a liability based on a simple fringe benefit calculation. To be technically accurate the lease liability should be split between a non-current liability and a current liability. That should be categorized as Vehicles under AssetsProperty Plant and Equipment.

Post by wazeer_81 Thu Jul 08 2021 104 pm. Your car rental company may claim deduction on expenses incurred on private hire cars that are rented out to customers subject to Sections 14 and 15 of the Income Tax Act 1947 ITA. Example 4 Residual value guarantees.

The monthly payment over 3 years is equal to 200. This separation between the assets ownership lessor and control of the asset lessee is referred to as the agency cost of leasing. Of cars in hand in a particular date should be all the cars u have.

Initial payment 10000 30 3000. Starts on 25-06-2021 to 07-07-2021. This is an important concept in lease accounting.

Total monthly payment 200 36 months 7200. During a presentation to SAVRALA members by accounting firm Deloitte Touche Trevor Derwin A A Partner in the Johannesburg office explained that the essence of the changes lies in the accounting treatment applied by lessees. U have just rented to partys not sold to them.

If a business leases a car for business use then HMRC rules dictate that normally only 50 of the VAT on the hire charge is recoverable. A car rental company refers to a company that rents out private hire cars for a fee. By establishing rental accounting systems early on youll be able to put yourself in the best financial position moving forward.

The key to a successful car rental company is effectivecurrent asset management. After deducting all expenses related to the car rental activity you have negative net incomea loss. Youre reporting the income and deducting expenses on Schedule C.

This article explains how to record the lease maintenance and VAT charges in Accounting. Dear Shabaz u need to maintain accounts as per AS-19. Accounting for Hire Purchase.

If during the first year of the lease the CPI increases from 100 to 105 ie. Ad With more than 15 years of experience in the online car rental market. I will male a down payment of 3k with business funds and finance the rest.

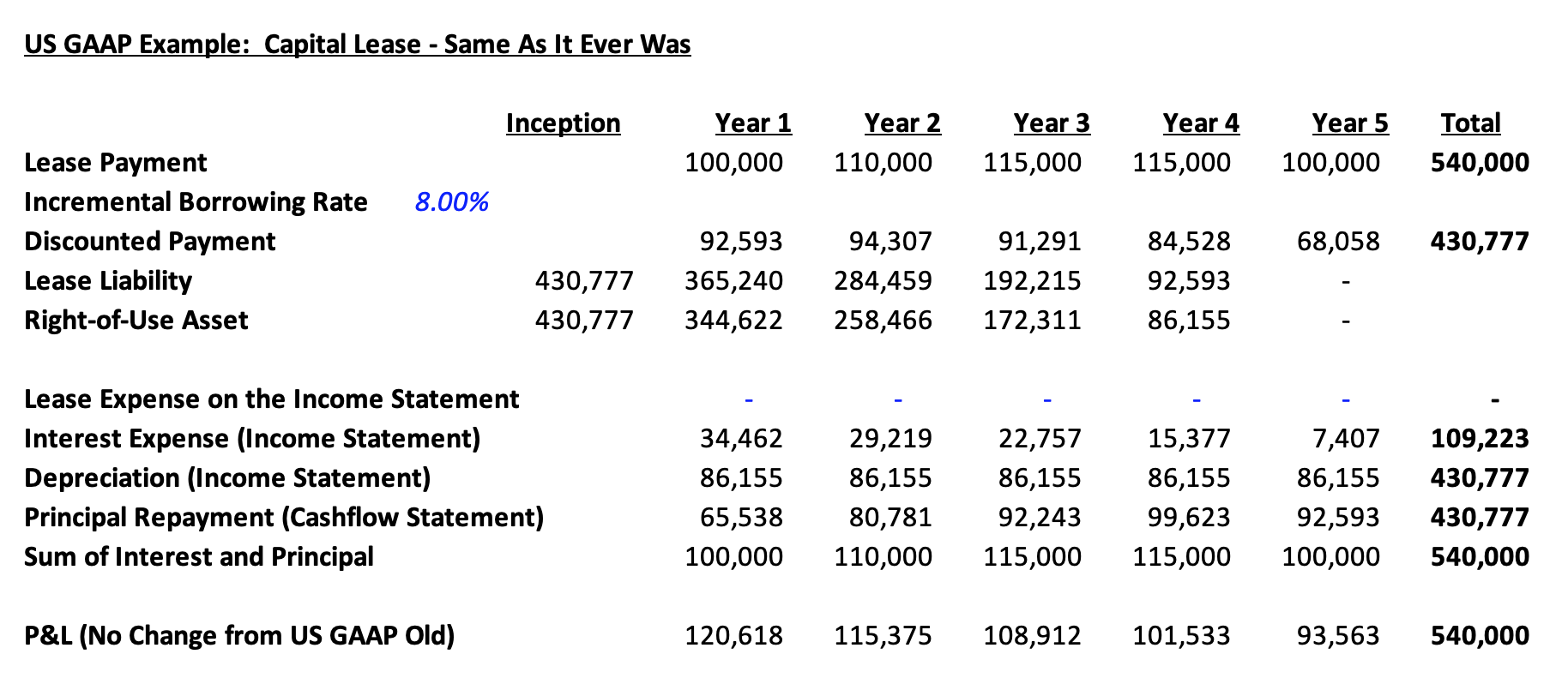

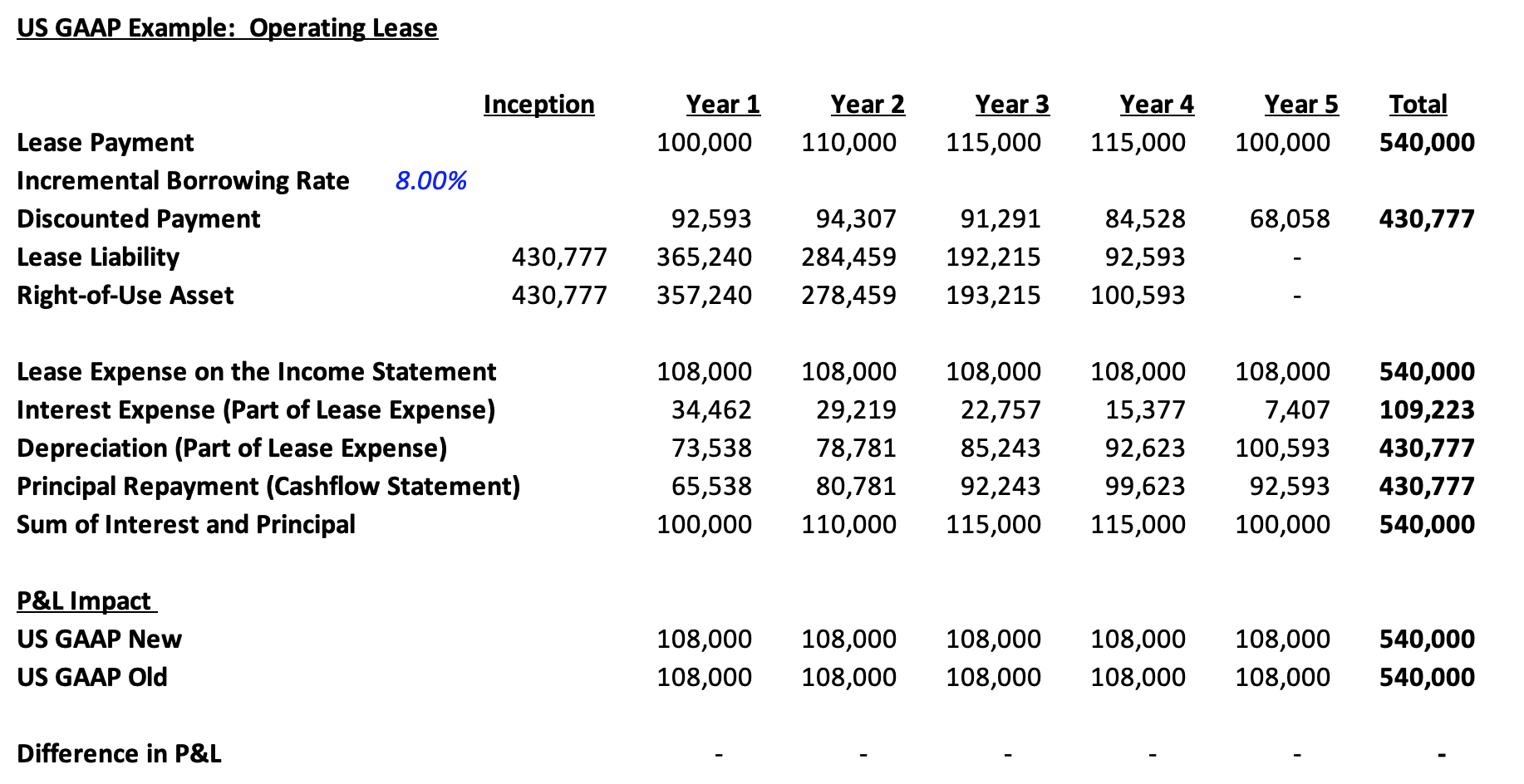

Lease Accounting Example and Steps. Lets walk through a lease accounting example. Accounting for landlords is important because it allows you to.

The invoice shows charges of 1000 plus VAT for. Capital allowances may also. If registration and operation are same then it will be treated as preliminary expenses.

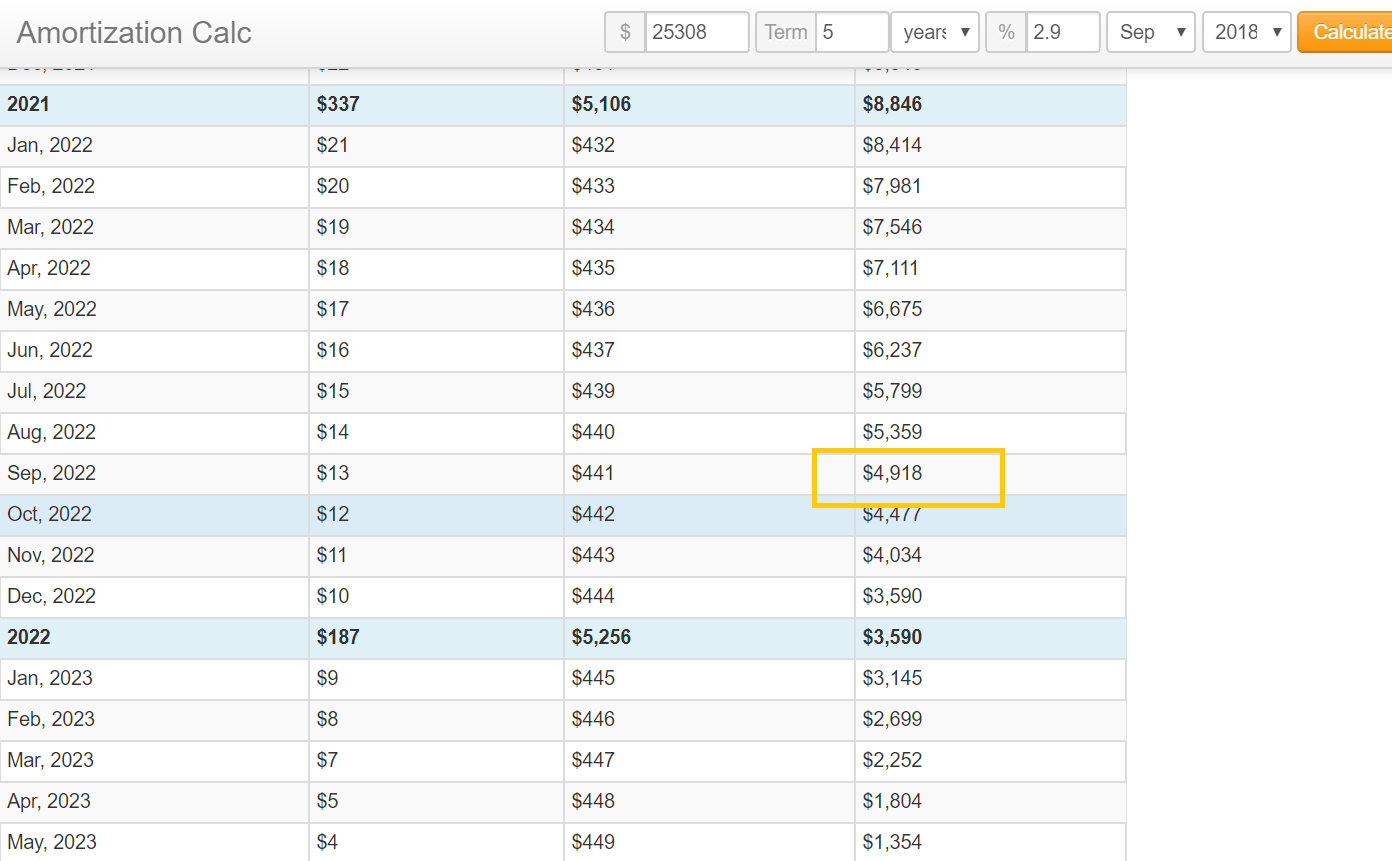

You are looking for the outstanding value of the lease 18 months after the lease agreement began. Ensure all financial obligations are met for each rental property. The cost is 15k.

Assuming that a company is profitable. If operation started before registration then it is normal expense. Ownership lies with u only.

Marek Muc Site Admin. On the transaction journal you would expect to see 3k from the cash account. This is because the majority of assets in a car rental company are the cars that it rents.

Car Rental Accounting treatment. Billiger-mietwagende Deutschlands größter Mietwagen-Preisvergleich. Gearing in the US can be as high as 81.

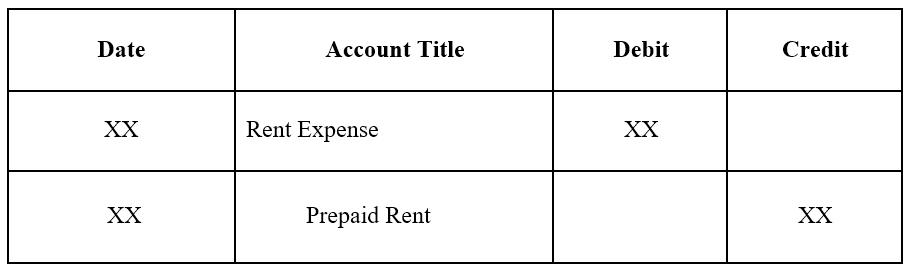

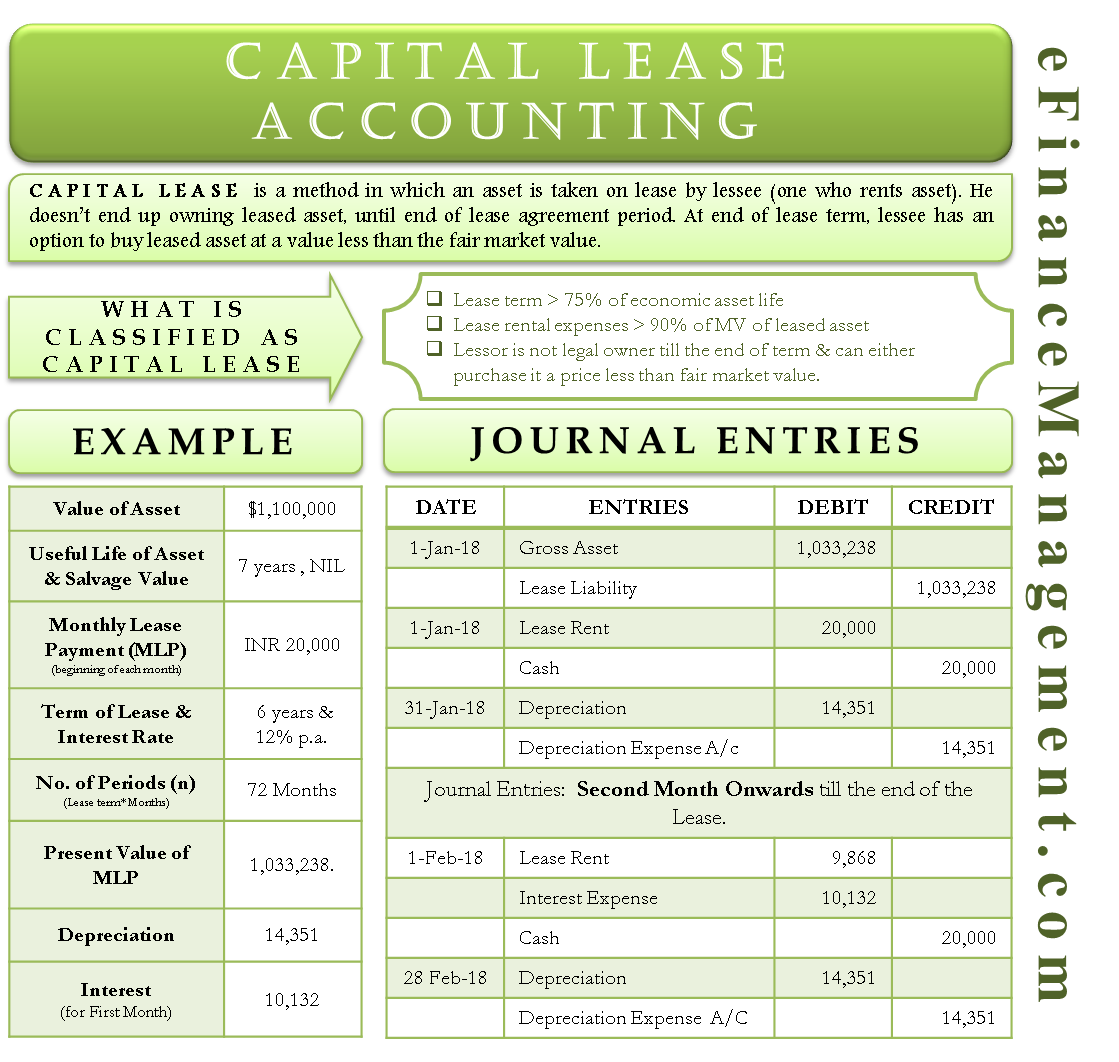

Rental payments in arrears Year Bfwd Interest rate given Rental Cfwd X X X X X To income statement finance costs To statement of financial position liability Tip. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense. For accounting purposes no special classification exists for HP contracts instead they are classified and accounted for as finance leases or operating leases depending on the nature of the contract.

You will need to create that if you havent already. At this point you must ask yourself whether this loss is limited by the passive activity rules. We guarantee that we will find a perfect offer for your rental.

These private hire cars are described as Private Hire in the Vehicle Log Card. Dears If I have a car rental contract falls between two months Eg. However in the case where the option to purchase the asset at.

Interest 3000 7200 10000 200. The accounting treatment under the two standards differs greatly. At present the costs pertaining to leased vehicles.

Example 1 Rentals in arrears treatment. This will have a substantial impact on car rental and leasing companies. In this example the company has received the latest invoice for the lease hire of a car.

Ad Tagesaktuelle Angebote für knapp 150 Anbieter aus über 170 Ländern. Do I need to record the revenue for the first 5 days from 25 to 30 -06-2021 or I need to recognize the revenue in July as the contract will be closed in July. Company registration and starting of operation are two different events.

It is advisable that you extend your lease table so that you have two separate cfwd balances the balance at the end of the accounting year 31 March and the balance at the end of the lease year 30 September. Hire chareges should be treated as Incomes. Applying IFRS 16 however would entail bringing the car onto the books in the form of a right-of-use asset with a corresponding lease liability the calculations of which are significantly more.

So for example lets say I purchase a vehicle that I will rent out. The higher the gearing of a car rental company the higher the return on equity. 2500000 105 100.

Most HP contracts which typically have a nominal purchase price are classified as finance leases.

Accounting For Leases The Marquee Group

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Prepaid Expenses Examples Accounting For A Prepaid Expense

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

A Refresher On Accounting For Leases The Cpa Journal

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Lease Accounting Calculations And Changes Netsuite

Capital Lease Accounting With Example And Journal Entries

Rent Deposit Accounting Journal Entry Double Entry Bookkeeping

A Refresher On Accounting For Leases The Cpa Journal

Rent My Car Is Turo Worth It In 2021 Financial Analysis And Tips

A Refresher On Accounting For Leases The Cpa Journal

Accounting For Leases The Marquee Group

Finance Lease Accounting Journal Entries Double Entry Bookkeeping

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

How To Calculate The Journal Entries For An Operating Lease Under Asc 842

A Refresher On Accounting For Leases The Cpa Journal